Algorithmic Trading Platform

An algorithmic trading platform for stock traders allowing them to build, backtest and fine-tune their trading strategies.

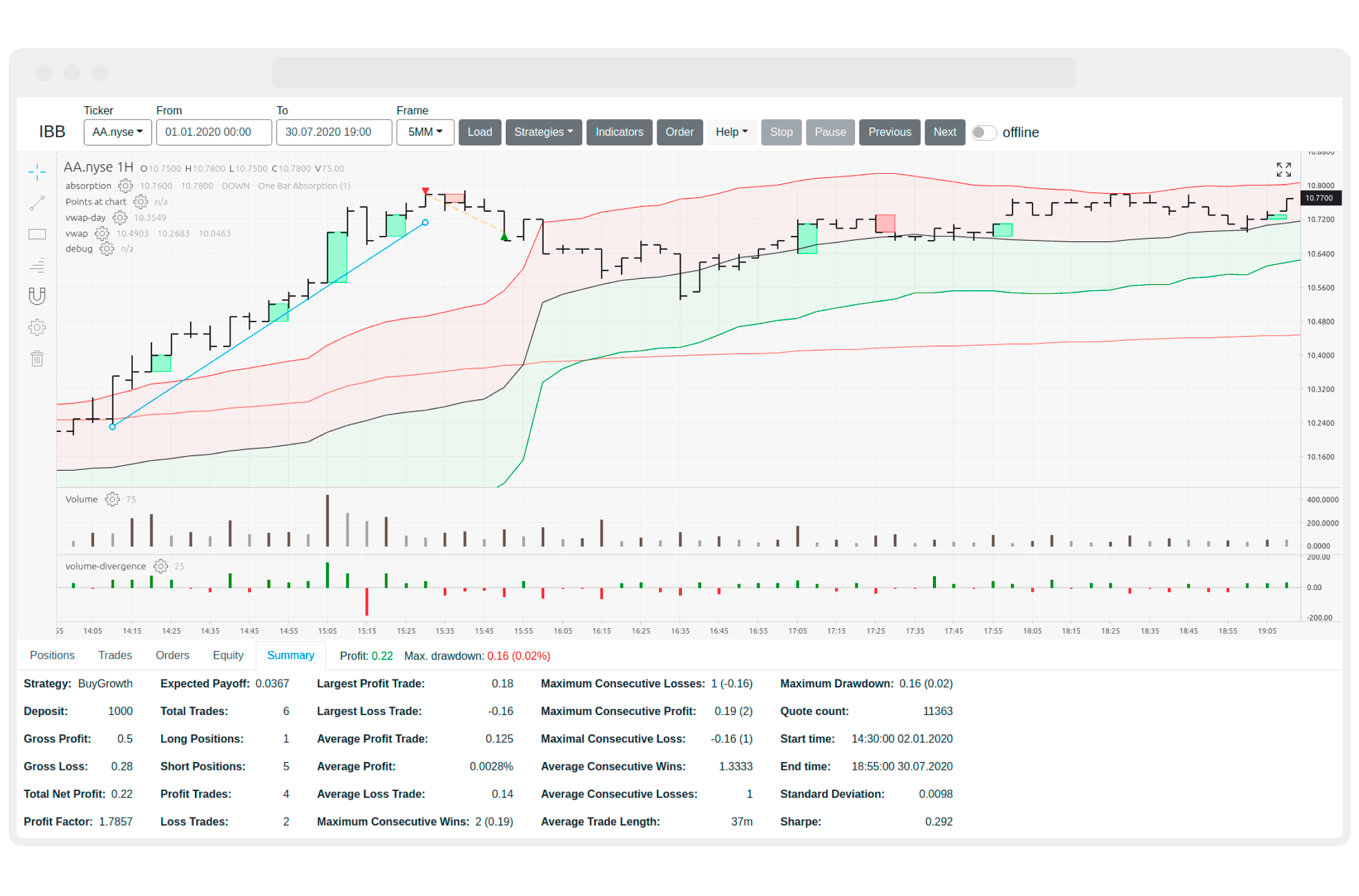

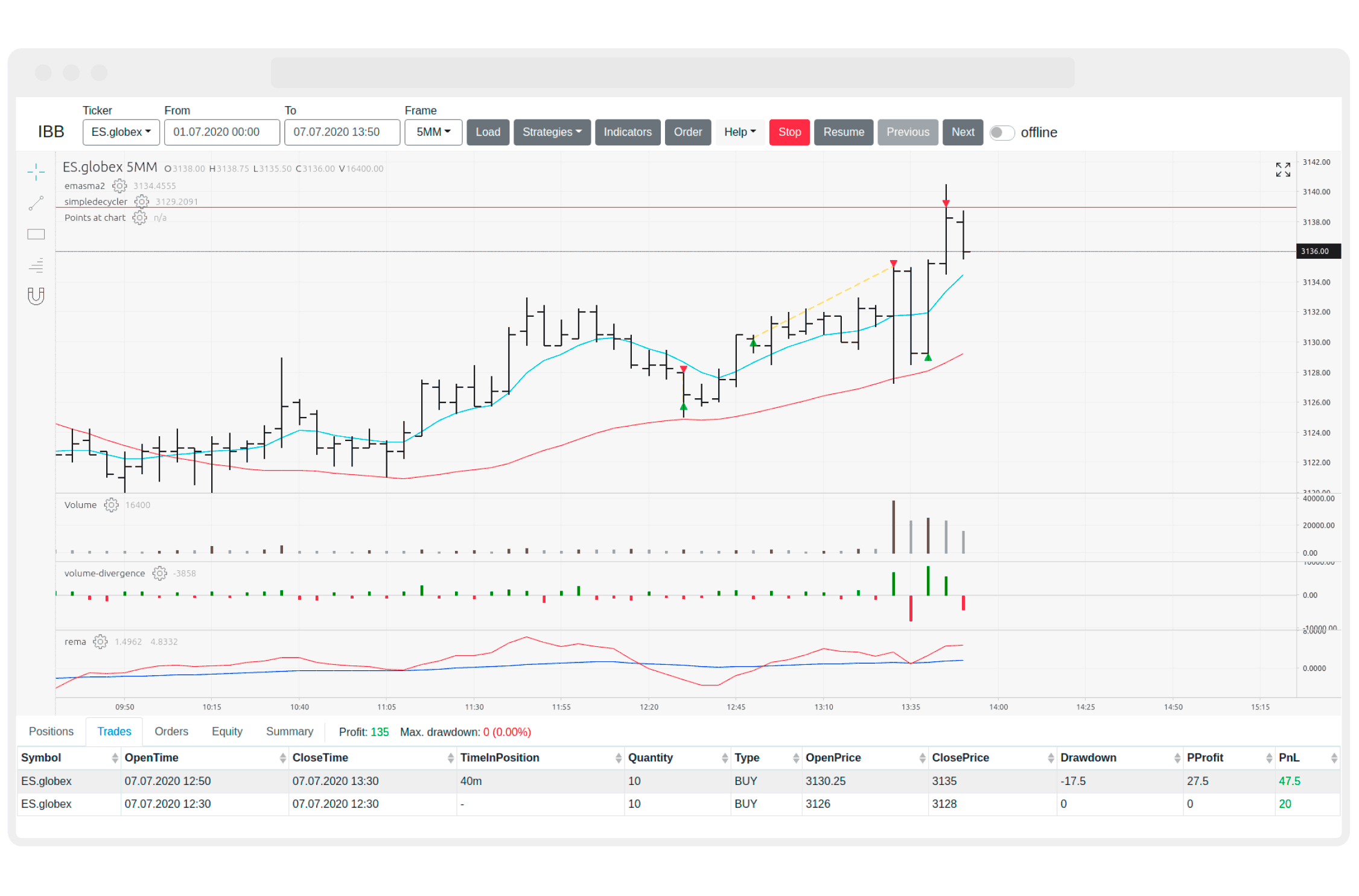

Open algorithmic trading and analytic platform (IBB)

The platform was built with Volume Spread Analysis and Price Action theories in mind and supports forward testing and real trading. For the server side and strategy coding, the native Go programming language was employed. This enables creating tiny executables without any dependencies at all whilst launching robots and trading strategies on microcomputers or the cloud.

Platform’s features

- Reap the benefits of built-in Interactive Brokers connections and support for adding new broker APIs as well

- Create custom indicators (IBB comes with a set of indicators including a moving average bundle, John Ehlers bundle, market delta and horizontal volume)

- Customise instrument scanners

- Display quotes, apply indicators and analyse data (with the help of drawing tools including trend lines, channels, blocks and others)

- Take advantage of bespoke stock pickers based on stock fundamental data

- Download and export historical data

- Develop custom trading strategies (e.g. pair trading, spread/seasonal trading and arbitrage) for scalping, swing and long-term investment strategies

- Conveniently switch to manual paper trading mode (i.e. trading simulation)

- Debug strategies using step-by-step mode

- Make use of a paper trading engine (broker simulation) with trade statistics

- Employ advanced statistics with main trading metrics

- Benefit from backtesting, forward testing and real-time trading support

- Enjoy an open source and extendable platform